Some things in life are not worth taking chances with

- datascienceinvestor

- May 6, 2023

- 2 min read

In an earlier article, I pointed out the fact that luck actually plays a big part in the investment journey of most. Many times, we got good returns because we might be lucky. Or skillful. Or maybe a combination of both. However, one thing is clear. There are always going to be events which have consequences so dire that they have the impact to make a dent on our savings and it are those events that we should never take chances with.

Misfortunes during travel are one of such things we should be very careful with.

And this is why it always pays to invest in proper travel insurance.

Allianz Travel Insurance is one of such proper travel insurance which you should definitely invest in.

It covers you against medical costs, cancellations and curtailments due to COVID-19. 24/7 assistance and support are also provided in case you run into any misfortunes during your trip. It is easily one of the most well-established travel insurances out there in the market.

If you are a traveller who likes to have a good coverage for general travel inconvenience, Allianz Travel Insurance is definitely one to consider.

Take the example below.

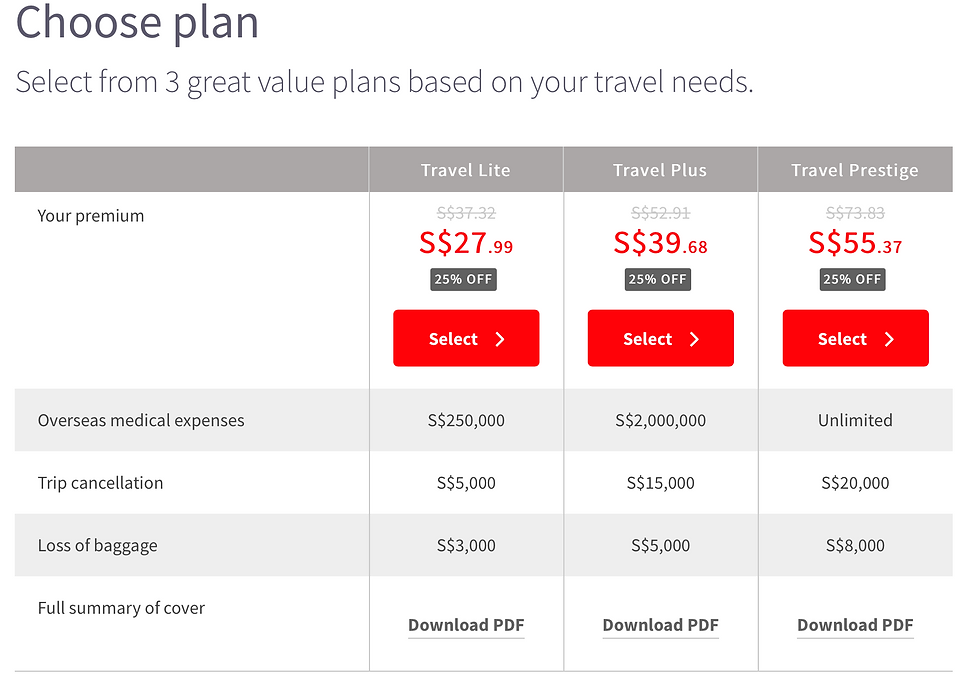

Let’s say you wish to travel to Bangkok for a 5-day vacation during the June holidays. Here is the quote I’m getting from Allianz Travel Insurance.

I will be comparing this with another favourite travel insurance for most Singaporeans- which is Singlife insurance. For the same travel period, this is the quote from them.

At the first glance, you can see that the prices between both insurance providers are very comparable. In fact, the mid-tier offering by Allianz Travel Insurance (Single Trip Silver) is even cheaper than the mid-tier offering by Singlife insurance (Travel Plus).

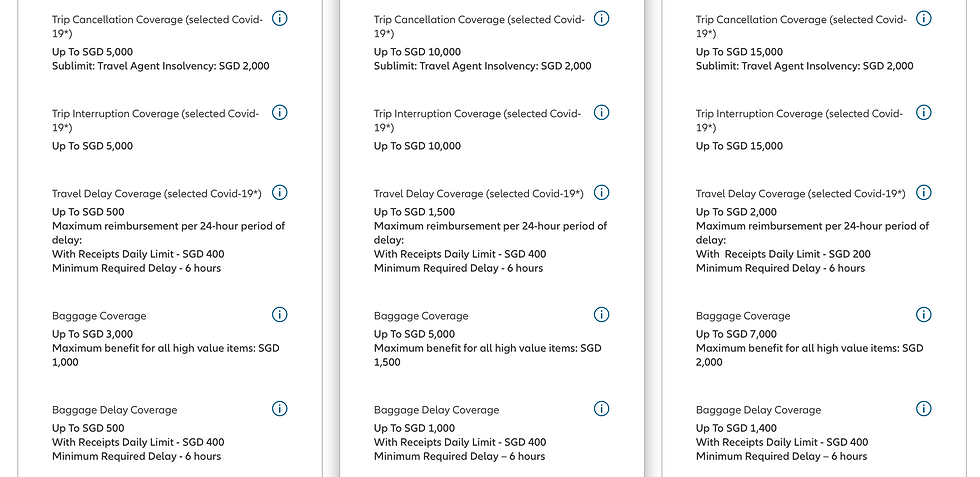

If coverage for travel inconveniences such as trip cancellation, trip delay, delayed baggage, loss baggage etc are your main focus in travel insurances, you will be happy to know that Allianz Travel Insurance do provide bang for the buck for you.

Using the same example above, here are the offerings by the two insurance providers.

You can see that both insurance providers are very similar in terms of coverage payout for various travel inconveniences. In fact, Allianz Travel Insurance offers higher travel interruption payout as compared to Singlife insurance. Personally, I find that the mid-tier offering by Allianz Travel Insurance is likely the most balanced choice among their three offerings and probably also the one that hits the sweet spot here.

If you are looking to travel soon, do consider Allianz Travel Insurance, especially since they are running a 40% discount campaign for all their travel insurances until the end of December 2023.

Do check them out here.

Disclaimer: This post contains affiliate links for Allianz Travel Insurance. However, all opinions expressed are my own.

I also do share additional content in my Telegram channel. Anonymous polls are also held in this channel to give you a perspective of what do the crowd thinks on certain financial/investment themes. Do join the channel if you are interested.

Comments