My experience with an insurance platform which returns you half the commissions

- datascienceinvestor

- Nov 8, 2021

- 6 min read

The idea of having a platform to simplify our search for a particular need has always fascinated us.

If you are looking for the best deal for a hotel, you will think of Trivago.

If you are looking for the best deal for airlines, you will think of Expedia.

You get the drift. We just love the idea of having a single space to consolidate all the different offerings that's available for a particular need of ours and do our bargain hunting.

Not too long ago, I was writing an article which allows you to look for the best deal on property mortgage insurance. You may read it here.

Now, what if you are looking for the best deal for insurance? Is there such a platform?

Yes, there is.

Recently, I came across MoneyOwl and I think it might be a good platform for you to consider for some of your insurance needs. Just to set the record straight, MoneyOwl has other services such as financial planning but the focus of this article is on their insurance services.

Let's first address the elephant in the room. Most of us already have insurance agents who handle all of our insurance needs. Why will there be a need for such a platform?

Here are my thoughts.

To be adequately covered, we will need a couple of insurance policies such as critical illness, life protection plan, hospital plan etc. While it's good to have an insurance agent to take care of all these policies for you, it might not be the most ideal reason. The simple reason is that most insurance agencies are only representing the products that their company is offering/providing. Hence, it's not going to be possible for you to purchase all insurance policies from a single agent which represent a single company and yet still get the best deal out of it. It just simply does not work that way. To look for the best deal, you need to have a platform which brings various insurance policies from different companies to you so that you can pick and choose the one which works best for you. This is exactly what MoneyOwl is about.

And of course, commissions. It's a known fact that commissions are earned out of the insurance policies purchased and I think it's only right that insurance agents get their commissions out of the hard work they put in. But what if there is an option for you (as the purchaser) to enjoy a 50% rebate of the commissions from the insurance policies you purchased? That certainly sounds attractive to me and that is also exactly what MoneyOwl provides.

If you read till this point, I'm sure you are interested to find out more. Now, let me explain more about how the platform works and also share my personal experience.

When you arrive at the MoneyOwl insurance page, there are just two simple options that you have to choose from.

(Source: MoneyOwl)

If you are unclear on your own insurance needs, you can do a questionnaire to find out more. If you already know what your insurance needs are and you just want to compare prices, you can go straight to the comparison chart.

Let's go with price comparisons first.

(Source: MoneyOwl)

Once you click on "Compare", you will be brought to a page where various insurance products (such as life insurance, critical illness, occupational disability etc) are shown. If you are unclear which one to choose, it's a clear sign that you should choose to do the questionnaire earlier on instead. This price comparison chart is more applicable for individuals who already know which insurance products they like to purchase and just want to make some price comparisons.

For each of these products, MoneyOwl only requires very basic information from you to do a comparison chart.

For instance, let's try Life Protection with the parameters shown in the above pic.

(Source: MoneyOwl)

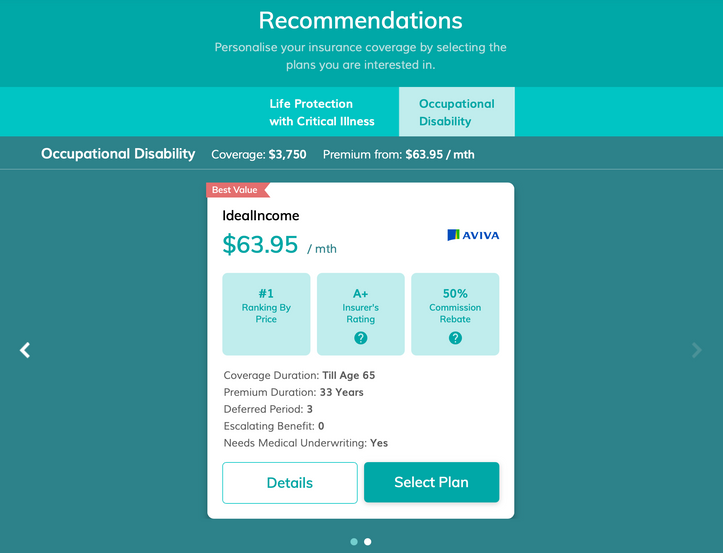

The search results will return you with offerings from different insurance providers. MoneyOwl will have already identified the one that they think has the best value. Of course, you can still look through the list to validate if the one they choose is indeed the best deal. In order to not complicate the comparisons, only key information is shown in this search results. If you want more detailed information such as payout details and unique features, you can click on details to find out more.

If you have already decided which plan is suitable for you, you can simply click on "Select Plan", keyed in your contact details and an advisor will contact you. Very straightforward. By the way, the Client Advisors from MoneyOwl are fully salaried so they are positioned well to give you conflict-free advice.

What if you have chosen to do the questionnaire instead?

Below are screenshots of a series of questions that you will be asked for MoneyOwl to determine what kind of insurance needs you should have.

Basically, the questions asked are what any financial advisor will be asking you when you first meet them. They are questions revolving around topics such as income, expenses, background etc). MoneyOwl simply consolidates them into a series of questions here so that you can do it as and when you like.

(Source: MoneyOwl)

There are a few things which I like about their questionnaire.

1) Great visuals. This makes things a lot easier to understand. The UX is really awesome.

2) The ability to retrieve information from your Singpass. When you are on the assets page, you do not need to key in all the information yourself. Instead, you can retrieve it via Singpass.

3) The level of details they go into planning for your insurance needs. On the dependent page, they even go into the details of asking about the specifics of university education that you might be planning for your dependent.

After a quick questionnaire, you will be brought to the result page.

(Source: MoneyOwl)

Insurance results are instantly shown to you- no need for you to register yourself before they send the results to your email address. Based on your answers to the questions, they can instantly show you what's the level of protection you will need.

Here is where they really make things easy for you.

For most of us, we probably already have some insurance policies. You can click on "Add Existing Coverage" and key in the existing coverage values that you already have. The results will deduct your existing coverage automatically so that you only need to concentrate on the "gap" between your needs and existing coverages. When you click on "Continue To Recommendations", the recommendations showcased will only focus on the additional coverage which you need. At this point of time, the results are in a similar format to what you see when you did a price comparison with the only difference being that the results shown here are specific to your needs so a lot more filtering is done here.

In my case, I was looking specifically for disability insurance and hence choose the more direct option of price comparison. Once I selected the plan which I'm interested in and keyed in the relevant details, a Client Advisor reached out to me within the next working day and an online appointment was set quickly and fuss-free. Throughout the appointment, the Client Advisor was patient and explained clearly to me the difference between the plan I selected and other similar plans out there in the market. There is absolutely no hard selling element as he even suggested other plans from insurance providers which are not on the MoneyOwl platform for me to do comparisons and find the one which suits me the most. I originally planned for a half an hour session with the Client Advisor but was genuinely impressed by his knowledge and expertise that the call easily got extended to an hour with me having to drop off for another appointment. Otherwise, this can easily be extended to a 2 hour discussion. I'm definitely pleased with the services and am seriously considering getting my disability insurance policy from this platform.

Overall, I think there is a lot of value in such platform services. What MoneyOwl offers is a very refreshing take on how one purchases insurance policies. What MoneyOwl is trying to do here is not to replace the human element here for insurance purchases. In fact, you notice that a Client Advisor will still be assigned to you at the end of the process. If you do purchase a plan via this route, your claim will still be supported or assisted by a group of Client Service Managers. What MoneyOwl try to do here is to streamline the whole process of buying insurance and very importantly, provide you with an agnostic platform to choose your insurance product from a group of insurance providers. This definitely makes a lot of sense to me and I'm certainly looking forward to supplementing my existing insurance coverage via them.

Did I also mention half of the commissions will be rebated to you?

MoneyOwl is currently also doing a promotion where you can get an all-new Apple AirPods (3rd generation) when you purchase term insurance with certain qualifying criteria. This promotion will end when 500 clients qualify for the promotion or 31 December 2021, whichever is earlier. Not that you should purchase insurance to get an AirPod, but I think this certainly sweetens the deal if you already have the intention to try them out.

If you like to give them a try, here's the link.

Remember, it doesn't hurt to try and there's nothing to lose.

Disclaimer: This post contains affiliate links for MoneyOwl. However, all opinions expressed are my own.

Comments