Are mixed development condominiums worth the price premium?

- datascienceinvestor

- Sep 16, 2020

- 4 min read

Mixed development condominium refer to condominium which is integrated with commercial activities in the same development. An example of a mixed development condominium is usually represented as a development with residential units being built on top of shopping malls, providing the residents with unparalleled convenience. Who wouldn't want to be able to just take a lift down and be able to access a huge variety of shopping and dining options without having the need to be exposed to the elements?

While such developments are indeed attractive in the offerings, they often also warrant a price premium as compared to the other developments in its vicinity. That got me thinking- are mixed development condominiums worth the price premium? By that, I mean does the price premium placed on these mixed development condominiums translates to better price appreciation from the investing point of view?

That's exactly what I like to explore in this article.

First, let's start off with understanding what are the various mixed development condominiums we have here in Singapore.

Below is a list of the majority of them (with sufficient number of transactions).

From this list, I then further explore the growth of their $psf transacted for each of these developments over the past 3 years and compare them against the general growth of $psf for the respective district to understand if these mixed development condominiums are appreciating better given the price premium they are warranting.

Here are the results.

For D13 (The Woodleigh Residences)

For regular readers of my blog, you all would have understood that I usually use the r coefficients of the graphs to understand how well the growth of the $psf is across a period of time. All data is extracted from the URA caveats published. In this case, you could see that the r coefficient for D13 is 0.27 while the r coefficient for The Woodleigh Residences is -0.07. Hence, it is clear here that the mixed development condominium here (The Woodleigh Residences) is not appreciating as well as the general district.

For D14 (Park Place Residences)

The r coefficient for D14 is 0.23 while the r coefficient for Park Place Residences is -0.45. Again, the mixed development condominium here (Park Place Residences) is not appreciating as well as the general district.

For D16 (Bedok Residences)

The r coefficient for D16 is -0.01 while the r coefficient for Bedok Residences is 0.11. In this case, the mixed development condominium here (Bedok Residences) is appreciating better than the general district.

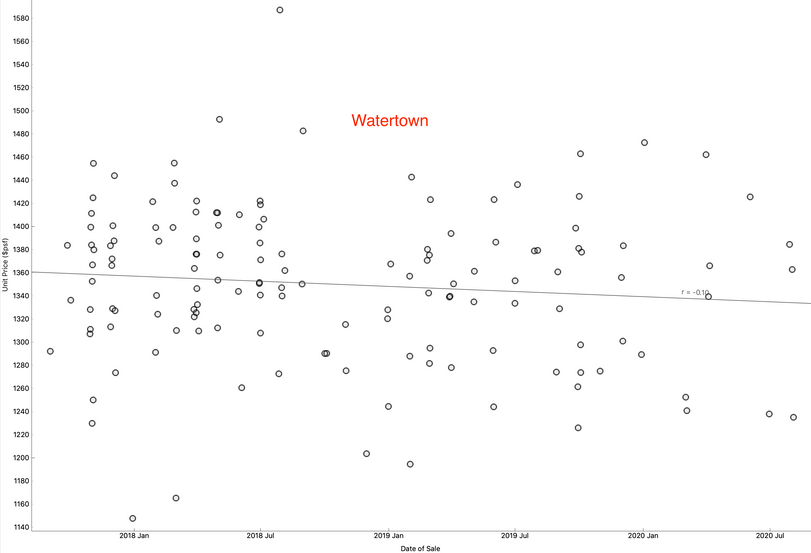

For D19 (Compass Heights, Watertown, Sengkang Grand Residences)

The r coefficient for D19 is 0.32 while the r coefficients for Compass Heights, Watertown and Sengkang Grand Residences are 0.05, -0.10 and 0.04 respectively. In this case, all three mixed development condominiums here (Compass Heights, Watertown and Sengkang Grand Residences) are not appreciating as well as the general district.

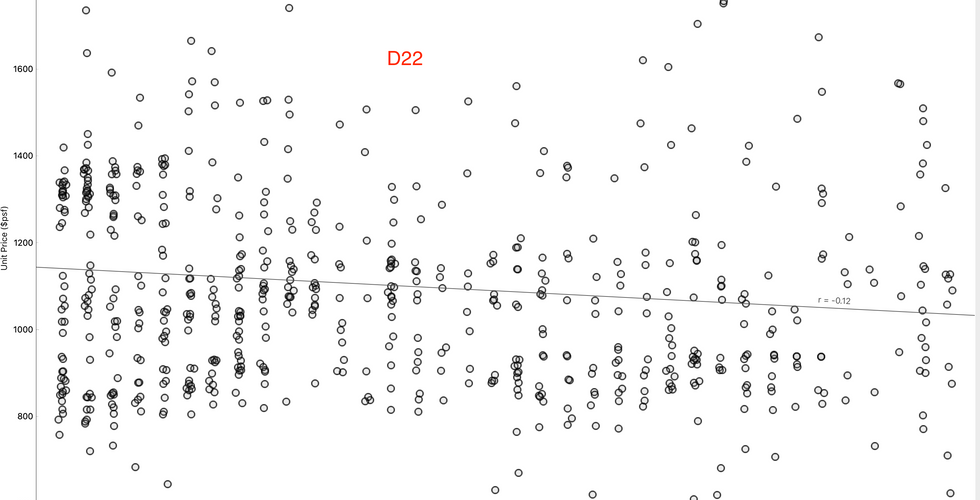

For D22 (The Centris)

The r coefficient for D22 is -0.12 while the r coefficient for The Centris is 0.39. In this case, the mixed development condominium here (The Centris) is appreciating better than the general district.

For D23 (Hillion Residences)

The r coefficient for D23 is 0.23 while the r coefficient for Hillion Residences is -0.4. Again, the mixed development condominium here (Hillion Residences) is not appreciating as well as the general district.

Lastly, D27 (North Park Residences)

The r coefficient for D27 is -0.1 while the r coefficient for North Park Residences is 0.64. In this case, the mixed development condominium here (North Park Residences) is appreciating better than the general district.

As you can see, most of the mixed development condominiums have lower appreciation in $psf growth as compared to their respective broader district over the past 3 years. To be exact, 6 out of the 9 projects fall under this category. The only exceptions are North Park Residences, Bedok Residences and The Centris. These are the few projects which outperform their respective broader districts in terms of $psf growth over the past 3 years.

And if you were to dig deeper, it's not hard to see why.

Let's take Park Place Residences as an example.

The average price transacted for Park Place Residences is $1896psf. This is significantly higher than the average $psf transacted for the other projects in its vicinity (The redder the bubble is, the higher the average $psf transacted for the project is. Similarly, the greener the bubble is, the lower the average $psf transacted for the project is. Refer to this post for more details.) You have Paya Lebar Residences just across the road, near to the MRT and the average price ($psf) transacted is just $1229- this is almost a difference of $700psf). What's more, Park Place Residences is of 99 year lease while the Paya Lebar Residences is of freehold status. This certainly puts Park Place Residences under pressure even though Paya Lebar Residences was completed more than a decade before Park Place Residences. Hence, having the status of being a mixed development condominium certainly does not help too much here.

If we were to look at the other end of the spectrum, we can take North Park Residences as an example.

The average price transacted for North Park Residences is $1340psf. There aren't too many other projects in its vicinity, unlike the Park Place Residences. Hence, North Park Residences has a comparative advantage in its location. Some of the nearer projects which were completed within a few years of completion of North Park Residences like Nine Residences and Symphony Suites are transacted around an average price of $1100psf- this is just a difference of around $200-$300psf yet North Park Residences offers much better convenience and connectivity). Hence, it's little wonder why North Park Residences is performing well in its $psf growth.

All in all, I would say that mixed development condominiums do offer great convenience to the buyers. Therefore, such projects will be great for buyers if the purpose is for self-stay. However, you might want to think twice if you are expecting mixed development condominiums to have better appreciation over the other projects simply because they are mixed development condominiums. Most of them have not demonstrated a better growth in terms of $psf and those who demonstrated better growth are usually projects which are priced rightly with little competition in its surroundings (eg. North Park Residence in Yishun and The Centris in Boon Lay). So if you are buying a mixed development condominium, do be comfortable with the fact that the price premium you are paying for is more for your own convenience rather than for better price appreciation!

Till the next time.

Last but not least.. please scroll down and subscribe for regular content if you like what you read!

Comments