All that glitters is gold.. or not?

- datascienceinvestor

- Mar 7, 2020

- 5 min read

Gold, gold, gold. All that glitters is gold..

or not?

The market has been volatile in the recent weeks with investors feeling the jitters from the impact of a few key events- reporting of awful financial results of companies due to coronavirus (Walmart and Apple have already provided warnings about the impact of coronavirus on their next quarter results) and Fed making an emergency rate cut (which has not happened since the 2008 financial crisis). In such turbulent times, some of the investors have begun to consider putting their money in probably one of the safest haven known to Man- which is gold.

Gold has been used as a currency throughout most of our history. The earliest known use is in 600 B.C. For thousands of years that follows, gold has always been traditionally known as a store of wealth. Despite the advancement in alchemy over the human history, nobody knows how else could they have gold with the exception of digging it from the ground. This makes its supply limited and hence the high value. This is in contrast to money, which central bank can create out of thin air from paper. This then led to a phenomenon where people turn to gold when they have no confidence with the monetary market or think that monetary collapse is imminent.

This is also why it's interesting to look at gold now, as many people have begun to believe that 2020 is the year of the bear market.

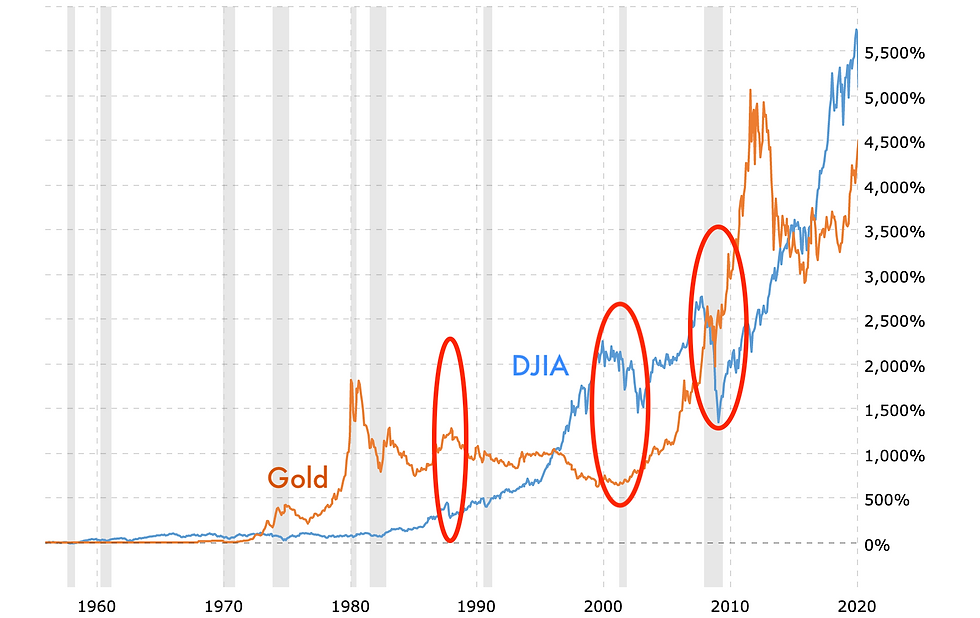

So, how has gold been performing as compared to the stock market since 1960?

In the recent decade, the stock market has provided a much better return than gold due to a really long bull run that we have since the last financial crisis in 2008.

Now, look closely at the graph and concentrate on the last 3 bear markets (as circled in the graph) in recent history.

-period between 2007 and 2009 (collapse of Lehman Brothers)

-period between 2000 and 2002 (bursting of dot com bubble)

-period in 1987 (heated escalated between U.S. and Germany over currency valuations)

You will notice that gold has always had a better performance than the stock market in all of these 3 bear markets. And this is also why investors have a strong belief that putting your money in gold is the best way to "survive" a bear market.

How well do gold really perform in these bear markets in absolute terms?

Here is what you get in terms of absolute percentages based on historical data. Gold has proven itself again and again in the past few bear markets. In fact, its performance is getting better and better! (25.5% gain in the most recent bear market as compared to 6.2% gain in the 1987 bear market)

While gold has always been the center of attraction among the precious metals, one precious metal which has been neglected of late has been silver.

Silver has been used widely in various different industries. Due to its low resistivity, it is used in almost every electrical appliance in the world. Its antibacterial properties also promotes its use in the medical profession. In terms of investment, how is silver different from gold then?

The silver market is 8 times bigger than gold (supply of new silver each year is close to 1 billion ounces while the supply of new gold is around 120 million ounces). Despite its larger supply, the market cap of silver has been dramatically smaller than gold (a difference of around ~5 times depending on market fluctuations). With a market capitalization of roughly ~1 trillion USD or so, it means that the entire silver market is even lesser than the market capitalization of companies like Apple! This makes silver very volatile (more so than gold) as it’s easier to move the prices of silver when it has such a small market capitalization. This is also why silver tends to rise more than gold on good days and drop more than gold on bad days.

Since silver has a much higher demand for industrial use as compared to gold, it is also more affected by the global economy state. In a strong economy where there is high industrial activity, demand of silver will be high and this will help its price. Similarly, in a weak economy where there is little industry activity, demand of silver will be low and its price will suffer. This is also why silver tend to do worse in recession periods.

If we include the performance of silver in the previous table, here is what we get based on historical data.

Now, you could see from the data that silver do have a track record of performing worse in the bear markets (as compared to gold).

An important indicator to look at when evaluating gold and silver will be the gold to silver ratio. Below is the gold to silver ratio for the past 100 years.

You could see that the current gold to silver ratio is 95 which is a twenty year high! The historical average has been around 50 to 60 which means that if reversion to mean is to happen, either silver will have a meteoric rise or gold will fall. For the past 100 years, gold to silver ratio has never exceeded 100 so it will be really interesting if we see if the ratio exceed 100 given the current momentum.

Several weeks ago, I wrote an article on the impact of COVID-19 (previously unnamed) on the market. In the article, I mentioned to my readers to put their attention on silver as the gold to silver ratio is approaching 90 back then, which is considered as historically high. Interestingly, silver did end up having its little run up with its price reaching almost 19USD/oz towards the end of Feb. However, as the situation now changes with the full economic impact of COVID-19 slowly unravelling, the prospect of an economic downturn/recession seems more highly probable than before. Hence, please do exercise caution when purchasing silver as it has been historically proven that silver tend to perform badly in a bear market.

It’s indeed interesting times now as we might be on the brink of an overdue bear market with a gold to silver ratio which is breaking historically highs! If a bear market is to arrive, gold is almost certain to be achieving more positive gains given historical records. At the same time, silver will be looking at further declines in prices given the same historical records. With the gold to silver ratio already rapidly approaching an all-time high in the past 100 years, such phenomenon will only continue to push the gold to silver ratio to reach an even higher value. This is certainly unprecedented territory.

What this potentially means is that there is a high chance that gold to silver ratio might break past 100 in the coming weeks/months if a bear market is to happen and a sharp/overdue recovery of silver prices will potentially happen when we are out of the bear market. Of course, this is mere speculation at this point of time.

Whether you believe that all that glitters is gold, or not, or maybe even silver, please do ensure your portfolio is well balanced enough to take you through these volatile times. It’s definitely not wise to put all your funds in commodities like gold or silver or both. Do also remember that a bear market is also the best time to be shopping for undervalued companies which has solid financial grounds and excellent business model. You might want to keep some funds ready to snap up the shares of these companies when the time arrived.

Here’s hoping all of us emerge unscathed in these "troubled times"!

(If you are looking at purchasing gold or silver, you may consider these ETFs instead of buying the actual gold or silver as it is more cost effective and easier to buy/sell. For gold, you can look at SDPR Gold Shares (Symbol: O87). For silver, you can look at iShares Silver Trust (Symbol: SLV))

Hope all these have been interesting for you. Do scroll down and subscribe for more of such articles!

Comments