This simple action can potentially save you thousands on your mortgage loan

- datascienceinvestor

- Jan 23, 2022

- 4 min read

Beauty often lies in simplicity.

That usually applies to investing or anything finance-related.

For instance, many of us like to do our own stock picking and try to beat the market even though we know that the odds are heavily stacked against us. In 2021, only 3 hedge funds beat the S&P 500. If you had known better, instead of spending hours on researching and finding the best stocks to buy, you could have just bought the S&P 500. You would have beaten many of the hedge funds in the market without spending much time on it. Simply just buy one thing (in probably minutes) and you would have had all the other time to do whatever else you love or spend time with your family.

That is one example of how a simple action, when done right, could reap you the most benefits.

Besides investing, that “simple action” can also be found in managing your mortgage loan.

I recently came across this article in PropertyGuru where a couple shared their story of how they managed to save themselves thousands of dollars just by refinancing their mortgage loan. What struck me is not the fact that they actually saved thousands of dollars by refinancing their mortgage loan. Instead, it is the fact that it took them 9 years to refinance their loan. And that's despite the fact that they actually knew that they were paying more than they needed to during these 9 years.

I initially found it hard to understand why it took them so long to take action when they were aware of an opportunity for greater savings all along.

When I dug deeper, I realised that many of us are probably guilty of the same thing. We let work consume us and end up spending whatever little time we have left on family or our hobbies. Getting down to refinancing your mortgage loan is not typically something we think of doing in our precious free time, especially when we can use our CPF to service our mortgage loan. Like the saying goes, out of sight means out of mind. We don't see our CPF monies in use and hence, we simply ignore the fact that we’re paying more for our mortgage loan.

This is where it gets really dangerous.

I don't think any of us would like to spend 9 years to arrive at the same conclusion as the couple in the article. Now, imagine what if there was someone or something who could constantly monitor the home loan markets and remind you regularly to refinance your loan whenever the opportunity comes up?

Sounds too good to be true? Well, it no longer is. Introducing the one simple action for mortgages that we’re talking about: getting started on SmartRefi by PropertyGuru Finance now.

(Source: PropertyGuru)

What exactly is SmartRefi?

SmartRefi is a simple and free service provided by PropertyGuru Finance to track your current mortgage against the interest rates of applicable loan packages in the market to calculate your estimated net potential savings. An email notification will be sent to you whenever there are savings tracked on your loan. PropertyGuru Finance's mortgage experts will help you process your refinancing if and when you decide to refinance.

While some might argue that there are few brokers who offer the same service, the SmartRefi service by PropertyGuru Finance takes it up a notch by helping you to constantly monitor your mortgage against what's available in the market by tracking the daily interest rates. Even if you have already decided on a bank, there is simply no harm in using PropertyGuru Finance as you can still access the loan packages by that particular bank through PropertyGuru Finance.

All you need to do is just a few simple steps.

Go to SmartRefi.

Choose your refinancing goal. I think the four options here pretty much cover all the reasons why any of us would like to refinance our home mortgage loan.

(Source: PropertyGuru)

Next, key in your respective details for the loan that you are currently servicing.

(Source: PropertyGuru)

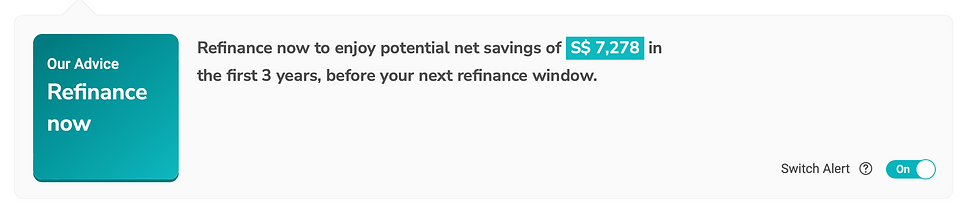

Your results will then be displayed as such.

(Source: PropertyGuru)

First, a piece of general advice will be given to let you know whether it's better to refinance now or later. You can toggle the switch alert on to receive email notifications when positive savings are tracked on your loan. This will be useful if you are told to refinance later. I strongly suggest everyone to toggle the switch alert on.

When you scroll down, you will first see what's the best rate in the market today. Next, you’ll see the breakdown of your savings in two categories (First 3 Years, Full Tenure). It's rather comprehensive as it also takes into account your refinancing costs.

(Source: PropertyGuru)

(Source: PropertyGuru)

If you then like what you are seeing, you can then book a consultation with their mortgage experts, who can address any questions you might have and assist you in your refinancing journey.

This whole process (aside from the consultation session) will simply take you just 5 minutes to complete yet the potential savings you could get from it is tremendous.

If there is only one simple action you’d like to take today for the most impact in cost savings, this could really be the one.

Get started on SmartRefi today.

Check out my other property related contents

Disclaimer: This post contains affiliate links for PropertyGuru Finance. However, all opinions expressed are my own.

Comments